program minimum and maximum for example, the loan might be constrained to a minimum of $10,000 and a maximum of between $250,000 and $1,000,000 depending on the lender.the borrower's age, with a higher amount available at a higher age.The exact amount of money available (loan size) is determined by several factors: Reverse mortgages in Australia can be as high as 50% of the property's value.

the borrower must own the property, or the existing mortgage balance must be low enough that it will be extinguished by the reverse mortgage proceeds, thus leaving the reverse mortgage as the only debt that remains secured against the property. the borrower must be over a certain age, usually 60 or 65 years of age if the mortgage has more than one borrower, the youngest borrower must meet the age requirement. To qualify for a reverse mortgage in Australia, Anyone who wants to engage in credit activities (including lenders, lessors and brokers) must be licensed with ASIC or be a representative of someone who is licensed (that is, they must either have their own licence or come under the umbrella of another licensee as an authorised credit representative or employee) (ASIC) Įligibility requirements vary by lender. īorrowers should seek credit advice from an accredited reverse mortgage specialist before applying for a reverse mortgage. Reverse mortgages are also regulated by the Australian Securities and Investments Commission (ASIC) requiring high compliance and disclosure from lenders and advisers to all borrowers. Under the Responsible Lending Laws, the National Consumer Credit Protection Act was amended in 2012 to incorporate a high level of regulation for reverse mortgage. Reverse mortgages are available in Australia. In the United States, reverse mortgage borrowers can face foreclosure if they do not maintain their homes or keep up to date on homeowner's insurance and property taxes. reverse mortgage borrowers – about 12% – defaulted on "their property taxes or homeowners insurance". In 2014, a "relatively high number" of the U.S. In Canada, the borrower must seek independent legal advice before being approved for a reverse mortgage. Moreover, the Bureau claims that many consumers do not use reverse mortgages for the positive, consumption-smoothing purposes advanced by economists. However, regulatory authorities, such as the Consumer Financial Protection Bureau, argue that reverse mortgages are "complex products and difficult for consumers to understand", especially in light of "misleading advertising", low-quality counseling, and "risk of fraud and other scams". Some economists argue that reverse mortgages may benefit the elderly by smoothing out their income and consumption patterns over time.

the borrower must own the property, or the existing mortgage balance must be low enough that it will be extinguished by the reverse mortgage proceeds, thus leaving the reverse mortgage as the only debt that remains secured against the property. the borrower must be over a certain age, usually 60 or 65 years of age if the mortgage has more than one borrower, the youngest borrower must meet the age requirement. To qualify for a reverse mortgage in Australia, Anyone who wants to engage in credit activities (including lenders, lessors and brokers) must be licensed with ASIC or be a representative of someone who is licensed (that is, they must either have their own licence or come under the umbrella of another licensee as an authorised credit representative or employee) (ASIC) Įligibility requirements vary by lender. īorrowers should seek credit advice from an accredited reverse mortgage specialist before applying for a reverse mortgage. Reverse mortgages are also regulated by the Australian Securities and Investments Commission (ASIC) requiring high compliance and disclosure from lenders and advisers to all borrowers. Under the Responsible Lending Laws, the National Consumer Credit Protection Act was amended in 2012 to incorporate a high level of regulation for reverse mortgage. Reverse mortgages are available in Australia. In the United States, reverse mortgage borrowers can face foreclosure if they do not maintain their homes or keep up to date on homeowner's insurance and property taxes. reverse mortgage borrowers – about 12% – defaulted on "their property taxes or homeowners insurance". In 2014, a "relatively high number" of the U.S. In Canada, the borrower must seek independent legal advice before being approved for a reverse mortgage. Moreover, the Bureau claims that many consumers do not use reverse mortgages for the positive, consumption-smoothing purposes advanced by economists. However, regulatory authorities, such as the Consumer Financial Protection Bureau, argue that reverse mortgages are "complex products and difficult for consumers to understand", especially in light of "misleading advertising", low-quality counseling, and "risk of fraud and other scams". Some economists argue that reverse mortgages may benefit the elderly by smoothing out their income and consumption patterns over time.

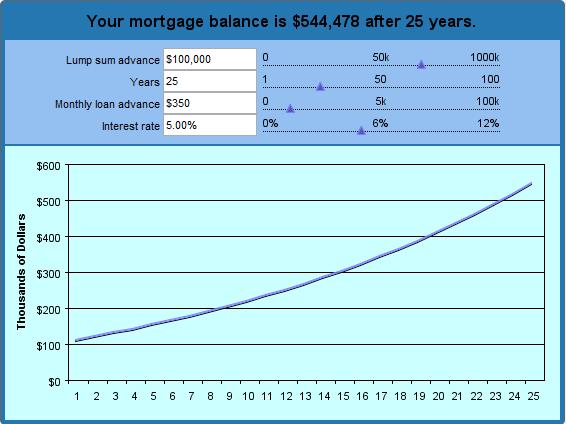

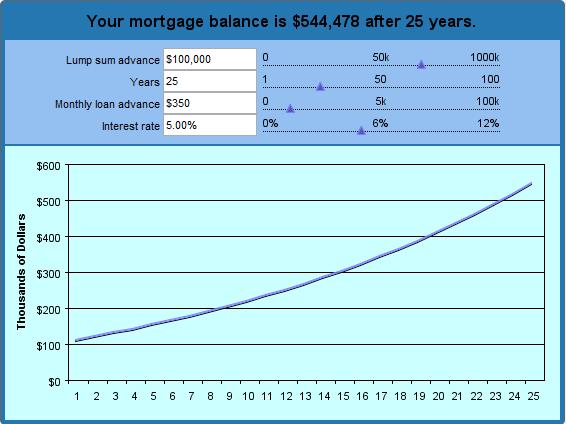

Regulators and academics have given mixed commentary on the reverse mortgage market. However, the borrower (or the borrower's estate) is generally not required to repay any additional loan balance in excess of the value of the home. The rising loan balance can eventually grow to exceed the value of the home, particularly in times of declining home values or if the borrower continues to live in the home for many years.

Because there are no required mortgage payments on a reverse mortgage, the interest is added to the loan balance each month. Reverse mortgages allow older people to immediately access the home equity they have built up in their homes, and defer payment of the loan until they die, sell, or move out of the home. Borrowers are still responsible for property taxes or homeowner's insurance. The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments. Loan to homeowners without monthly paymentsĪ reverse mortgage is a mortgage loan, usually secured by a residential property, that enables the borrower to access the unencumbered value of the property.

0 kommentar(er)

0 kommentar(er)